Buying a home is an expensive and important decision, so it’s important to do your research before making a purchase. In this article, we’ll review the 2-10 Home buyers Warranty and explain what it is, what benefits it offers buyers, and how much it costs. Hopefully, this information will help you make the best possible decision when purchasing a home!

Buying a home is an important decision, and one that you should not take lightly. That’s why it’s important to have as much information as possible about the home buying process before you make your purchase. In this article, we’ll be covering 2-10 Home buyers Warranty, and how it can help you protect yourself if something goes wrong with your new home.

What is a home buyer warranty?

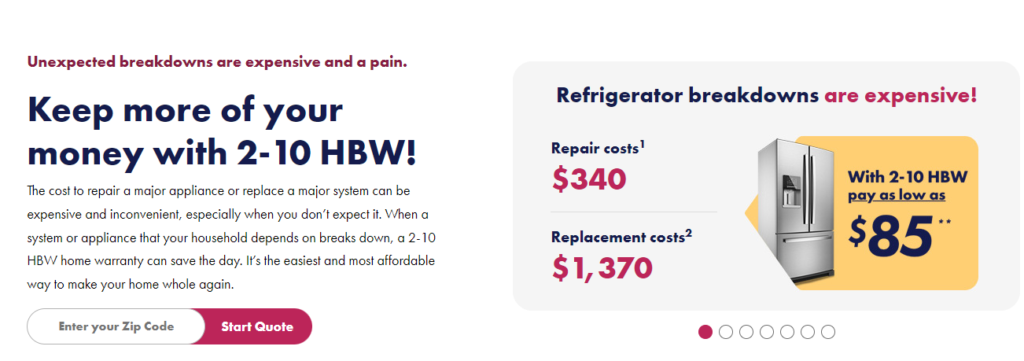

A home buyer warranty is a protection plan that homeowners can purchase to cover some of their costs should there be any problems with their home. This type of warranty can come in different forms, but typically it covers the cost of repairs or replacement of property.

When buying a home, it’s important to know what kind of coverage your purchase may include. Home buyers warranties can vary in terms of the amount of coverage they offer and the time period during which it’s valid. They may also have exclusions, which means that they won’t cover certain types of damage.

Generally, a home buyer warranty will be valid for one year from the date of purchase. However, some plans may be longer, while others may have shorter durations. If you have any questions about what kind of coverage your purchase may include, be sure to ask your real estate agent or broker. They are likely to have more information about this type of protection plan.

How Much Does It Cost to Purchased a 2-10 Home Buyers Warranty?

When you purchase a home, it’s important to protect your investment. That’s why many home buyers purchase a home buyers warranty.

A home buyers warranty is a insurance policy that covers defects in the property that you have just bought. The policy can cover things like water damage, roof damage, and more.

There are two main types of home buyers warranties: general and specific. General home buyers warranties cover most defects, while specific home buyers warranties only cover certain defects.

Most home buyers warranties cost between $2,000 and $10,000. It’s important to read the terms and conditions of the warranty before you buy it so you know exactly what is covered and what is not.ede some or all of the risk associated with a home purchase. The warranty typically covers defects in construction and materials that occur within a specific time frame after the home is purchased, usually one year.

Types of warranties

There are a few types of warranties that home buyers can purchase. These include the standard warranty, the extended warranty, and the purchase protection warranty.

The standard warranty is the most common type of warranty. This warranty covers defects in the materials or workmanship of the home during the term of the warranty. It usually lasts for one year.

The extended warranty is a type of warranty that covers additional problems that may occur after the home is purchased. This type of warranty usually lasts for two years, and it can be added to a standard warranty.

The purchase protection warranty offers extra protection to buyers if they decide to sell their home within a certain time period after purchasing it. This type of warranty usually lasts for three years.

Some warranties cover only specific types of problems, while others are more general. It is important to read the terms and conditions of any warranty to understand what is covered and what is not.

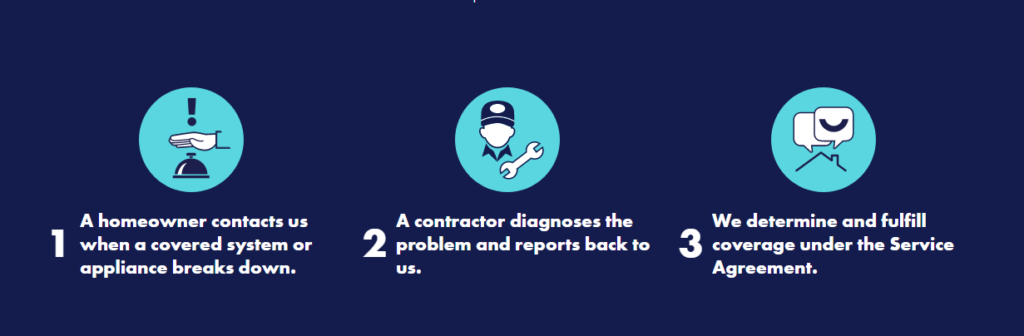

What happens if I need to file a claim?

If you have a warranty issue with your home, you need to file a claim. In most cases, you will need to contact the company that provided the warranty.

Some companies will send a repair person to your home, while others will require that you bring the item in for repair. Regardless of the path you take, make sure to keep all of your paperwork related to the claim. This includes your purchase agreement, warranty card, and any other documents related to your warranty.

If you have a warranty issue with your home, you should contact the home buyer warranty company. The company will help you file a claim and resolve the issue.

There is no charge to file a claim, and the company will usually take care of everything. However, there may be some costs associated with the process. The company usually charges a fee for its services, and this money is usually refunded to you once the claim is resolved.

The cost of filing a claim will vary depending on the company and the issue involved. However, it is usually not too expensive to get repairs or replacements done.

What do the coverage options include?

When you buy a home, you may be interested in buying a home warranty. This is a protection plan that covers your home if there are any problems with it. There are several different types of home warranties, and each one has different coverage options.

Some coverage options include repairing or replacing the parts of your home that are broken or damaged. Other options may cover repairs or replacements for things like water damage or structural defects. You should review the coverage options in detail when you are shopping for a home warranty. This will help you to find the best option for you and your family.

When buying a home, it is important to understand the home buyers warranty. This policy provides coverage for repairs or replacements made to the property during the warranty period. There are several different coverage options available, and each has its own benefits and costs.

The most common coverage option is the standard warranty. This policy covers repairs or replacements made during the policy period, which is usually one year. The cost of this policy is usually a flat fee, although it may also include some additional costs, such as deductible amounts.

Another common coverage option is the extended warranty. This policy covers repairs or replacements made during the policy period and up to two years after the policy has been issued. The cost of this policy varies, but it is usually more expensive than a standard warranty. The main difference between an extended warranty and a standard warranty is that an extended warranty includes coverage for things like flood damage.

Does the warranty cover damage caused by water, wind or fire?

Some homebuyers may be wondering if their warranty covers damage caused by water, wind or fire. The answer to this question is unfortunately not always clear.

Most home warranties only cover damage caused by water, wind and fire. However, some home warranties may also cover other types of damage, such as glass breakage. It’s important to read the terms and conditions of a warranty carefully to determine exactly what it covers.

Home buyers have many different warranties to choose from, but what is the difference between them?

Warranties can differ in terms of what they cover. Some will only cover damage caused by water, wind or fire. Others might cover more than just those three types of damage.

The warranty also varies in terms of how much it costs. A very basic warranty might cost $50-$100, while a more comprehensive warranty might cost $1,000 or more.

A home buyers warranty is a contractual guarantee provided by a property seller to the buyer that covers damage caused by water, wind or fire.

The warranty typically includes coverage for both physical and structural damage. Physical damage refers to any damage to the property that can be seen or touched, such as water damage or broken windows. Structural damage refers to any damage that affects the structural elements of the home, such as cracked walls or floors.

Most warranties cover both physical and structural damage, but they may vary in terms of which types of damage are covered. Some warranties only cover physical damage, while others cover both types of damage.

Warranties typically have a duration of one year, but they may also have longer durations. They usually have a deductible amount, which is the amount of money you have to pay before the warranty kicks in. The deductible amount varies depending on the warranty, but it is usually around $500.

Home buyers warranties can cost a lot of money, but they are worth it if you experience any type of property Damage during your purchase process.

What if I can’t use the warranty because my house is already damaged?

If you purchase a home and the house is already damaged, you may not be able to use your home buyers warranty. The warranty is designed to protect you from defects in the property that you have purchased. If the house is already damaged, it would be considered a defect and you would not be able to use the warranty.

The cost of a home buyers warranty varies depending on the company and the type of warranty offered. Some companies may charge a one-time fee while others may require you to pay an annual fee. The cost of a home buyers warranty usually depends on how comprehensive the coverage is.

If you purchase a home and are not able to use the warranty due to damage to the house, there are options available to you. First, you cancontact the seller and ask if they will cover the cost of repairs. Second, you can try to get a repair contract in place with the seller. This will allow you to make repairs and deduct them from your monthly mortgage payment. Finally, you can file a claim with the warranty company.

Conclusion

A home buyers warranty is a type of insurance that protects you, as the buyer, in the event that something goes wrong with the property you just bought. In some cases, it can cover things like plumbing and electrical malfunctions. While they vary in price depending on the coverage offered, a typical policy will cost around $100 per year. So if something does happen and you need to get repairs done on your new home, it’s worth looking into getting a home buyers warranty.