Top 10 Best Payroll Services & Companies – Simplify Employee Payments

Paying your employees on time and without any problems used to require a lot of work. But with convenient payroll services online, today’s employers are doing so with ease. What used to be a nightmare for the payroll administrator is now a simple task of clicking or tapping a few times to get things rolling. In fact, there are even payroll service providers that offer fully automated payroll runs. So, you can get all of your workers paid promptly and without a hitch without even lifting a finger. In times of economic belt-tightening, it’s important to be efficient as possible, and payroll services help you automate tasks that in the past would have cost you manpower.

From the major corporate services to simple payroll services for small businesses, there’s something for everyone out there today looking to get their payments in order for 2022. You just need to know where to look. If you’re tired of spending hours of time poring over the grueling task of crunching numbers and cross-referencing data frames, it’s time you stepped into the 21st century and got yourself a reliable payroll software. Here are 10 of the top payroll services and where they really shine.

Best Business Payroll

Services

u

u

u

u

u

#1

- Best for:- SMBs, independent contractors, freelancers

- Starting Price– From $6 per month per person

- Benefits & HR-Medical, dental, vision, 401k, commuter

- Apps- No

#2

- Best For:- Powerful payroll services mid-enterprise biz

- Starting Price:-From $3 per month + $6 per employee

- Benefits & HR:- 401k, SIRA, SEP IRA, health, workers’

- Apps: Yes

#3

- Best For:-SMBs looking for more than just payroll

- Starting Price:-Quote-based

- Benefits & HR:- Health, retirement, onboarding, management

- Automatic tax filing: Yes

- App: Yes

#4

- Best For:-Comprehensive general ledger-linked payroll

- Starting Price:-From $22.50

- Benefits & HR:- Health benefits

- Automatic tax filing: Yes

- App: Yes

#5

- Best For:-SMBs, startups, enterprise corporations, restaurants, retail, healthcare, contractors

- Starting Price:-From $39 per month

- Benefits & HR:- Works with all third-party benefits, including 401K, workers’ comp, unemployment insurance, garnishments

- Automatic tax filing: Yes

- App: iOS & Android

#6

- Best For:-Businesses seeking scalability

- Starting Price:-From $49 per month, $3 per user

- Benefits & HR:- 401k, child support, health

- Automatic tax filing: Yes

- App: Yes

#7

- Best For:-Small businesses and independent accountants

- Starting Price:-From $36 per month + $4 per person

- Benefits & HR:- 401(k), worker’s comp, health insurance

- Automatic tax filing: Yes

- App: Yes

#8

- Best For:-Automatic filling of tax benefits and payroll processing

- Starting Price:-$8 per user per month

- Benefits & HR:- Yes. Benefits tracking through sync with HR management

- Automatic tax filing: Yes

- App: Android, iOS

#9

- Best For:-Employee benefit

- Starting Price:-From $8

- Benefits & HR:- 401k, supplemental, FSHA HSA, commuter

- Automatic tax filing: Yes

- App: Yes

#10

- Best For:-Hourly employees, retailers, SMBs

- Starting Price:-From $29

- Benefits & HR:- Health, 401k, workers comp, pre-tax

- Automatic tax filing: Yes

- App: Yes

1

Gusto

Our reviews come from verified users–just like you!

The star ratings are based on the overall rating of each brand. Some reviews are provided via third party suppliers. We encourage you to write a review of your experiences with these brands.

- Best For- SMBs, independent contractors, freelancers

- Starting Price - From $6

- Plans - Medical, dental, vision, 401k, commuter, 529

Gusto is one of the best payroll services for small businesses of today, and it’s also a good choice for freelancers and contractors. Providing automatic tax filing, a list of HR benefits, including health, dental, vision, college funds, 401k, and the ability to run unlimited payrolls, Gusto is a cost-effective way for businesses to streamline their monthly accounts.

It’s also nice that Gusto integrates with a lot of other applications, including accounting programs like QuickBooks Online, Xero, and FreshBooks. You can also sync your time tracking apps (like Time Tracker or Homebase) and expense management tools like Expensify to have an all-inclusive database for your accounts.Prons

- Loads of useful integrations

- Fully automates payroll and taxes

- Good for contractors and freelancers too

Cons

- No 24/7 customer support

- Not all HR benefits available in all states

2

ADP

- Best For-Powerful payroll services mid-enterprise biz

- Starting Price - From $39

- Plans -401k, SIRA, SEP IRA, health, workers’ comp

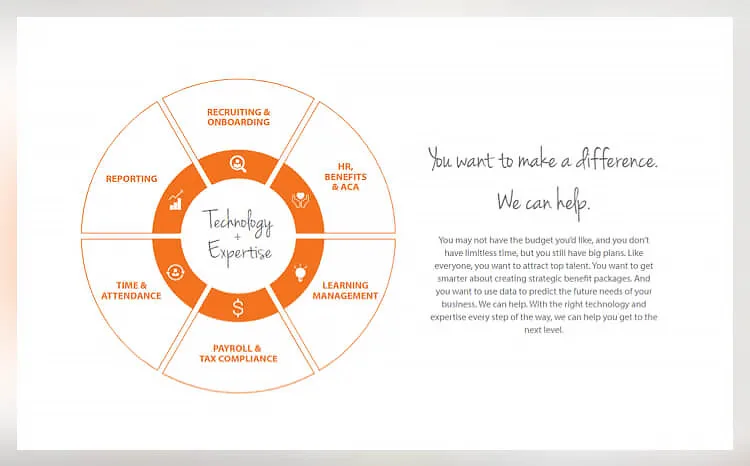

ADP is one of the oldest payroll services online or off, which should tell you something about how much experience these fellows have under their belt. Offering a full range of HR benefits and services, payroll services, and time and attendance management, ADP is a professional payroll service for businesses looking for more than your basic software. From HR guidance, resources, and dedicated service managers to full tax compliance, reporting, and self-service capabilities, ADP has an impressive array of features and services on offer.

ADP will automatically calculate tax liability, withhold and pay taxes on your behalf, and handle all reporting and issuances, including W-2s and 1099s. What’s more, ADP doesn’t just stop at your local boarders. This payroll service handles issues in more than 140 countries around the globe.

Prons

- Professional, top-rated features and service

- Oldest payroll services online

- Full service, all-inclusive benefits & payroll

Cons

- Not as cheap as some competitors

- No pricing plans for really small businesses

3

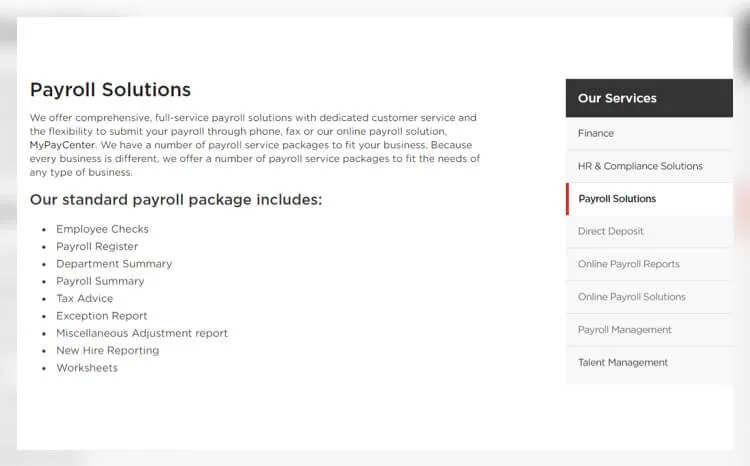

Paychex

- Best For-SMBs looking for more than just payroll

- Starting Price - Quote-based

- Plans -Health, retirement, onboarding, management

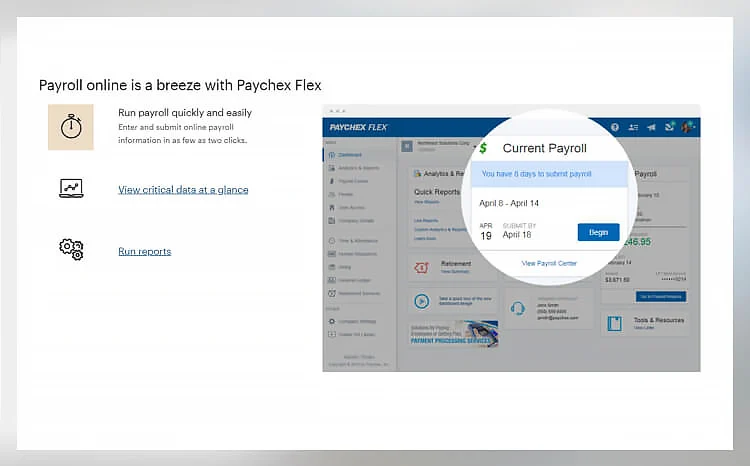

Paychex is a cloud-based payroll services provider that has plans for every size business but is particularly well-suited for smaller businesses up to 50 employees. Paychex Flex, the SMB-focused plan, lets you update the database via desktop or mobile dashboard, set automated rules, and run payroll quickly and efficiently. In fact, with self-service, Paychex lets your employees take the bulk of the data input off your shoulders entirely.

Subscribing to AT&T is worthwhile for families, but less so for individuals. That’s because the plans are quite expensive on a per-user basis for one or two users, but decently priced if you’re paying for four or five lines. AT&T offers faster speeds than third-party operators that use its infrastructure, making it a good option for families that use a lot of mobile data.

Prons

- User-friendly software anyone can run

- Great choice for small businesses

- Affordable without missing out on features

Cons

- Lots of reports options can be confusing

- New version launch takes getting used to

4

Quick book

- Best For-Comprehensive general ledger-linked payroll

- Starting Price - From $22.50

- Plans - Health benefits

QuickBooks by Intuit is another well-known name that has recently stumbled into the payroll industry. A reputable accounting software, QuickBooks now offers payroll services that sync seamlessly with all of your accounting programs for a 360-degree inclusive service.

Like the other big telecommunications companies, Verizon targets the premium segment of cell phone customers. It isn’t the cheapest cell phone plan provider, but it more than makes up for this with its high speeds and extra perks like 6-12 free months of Disney+, Apple Music, and Discovery+. The child-friendly plan (with parental controls) makes it a particularly good option for families with underage kids

Prons

- Smooth onboarding support

- Extensive tax-filing features

- Fully integrates with your accounting software

Cons

- Not as customizable as competitors

- Not as many features included in basic plans

5

Deluxe

- Best For-SMBs, startups, enterprise corporations, restaurants, retail, healthcare, contractors

- Starting Price -From $39 per month

- Plans -Works with all third-party benefits, including 401K, workers’ comp, unemployment insurance, garnishments

Deluxe has flexible payment options like direct deposit, pay cards, or paper checks. These can be set to a regular pay cycle for automated payroll processing. Employees will appreciate that they can access their own payroll reports that include deductions, spendings, and even paid time off. Deluxe also manages your HR benefits, providing online enrollment and custom HR document management.

Prons

- Allows you to spread costs among up to 10 people

- Runs on Verizon Wireless 5G network

- Switch plans any time you need

Cons

- Unlimited plans slow down after 20 GB data usage

- By the Gig plans only run on 4G LTE

6

Paycor

- Best For-Spreading costs across up to 10 people

- Starting Price -$15 per month

- Plans -Unlimited; By the Gig (1-10 GB)

Another interesting thing about Visible Wireless is its “Party Pay” group discounts. Basically, it offers the same “Unlimited” plan to all users in month one. In the second month, you have the option of bringing on board friends to earn savings. If you add one friend, you save $5/ month, two friends saves you $10/month, and three friends or more saves $15/month (i.e., with groups of four, everyone pays $25/month per line).

Prons

- Big discounts for referring friends

- Genuine unlimited data

- Flexible billing options

Cons

- Only one type of plan

- Data slows down at peak times

7

OnPay

- Best For-Small businesses and independent accountants

- Starting Price -From $36 per month + $4 per person

- Plans -401(k), worker’s comp, health insurance

From its clean, easy-to-use interface to its single pricing structure, Onpay offers an accessible yet customizable payroll platform for small and growing businesses. Onpay may not be the biggest product in the payroll market, but it offers surprising depth and capabilities that allow businesses to streamline their payroll needs without much legwork

For the payroll service itself, Onpay covers all the bases that a small business would need: the platform helps you easily do payroll for W2 employees and 1099 contractors, with automated tax filings and payments, and handles HR benefits, workers comp, and insurance for 50 states. Onpay also has an impressive slate of integration capabilities, allowing you to integrate time-tracking and accounting software that seamlessly syncs with the platform. In addition to all of that, the customer support team is responsive and adept at answering questions in a timely manner.

Prons

- Extremely accessible and user-friendly

- Integrations with Quickbooks, time-tracking software, and more

- Automated tax filing

Cons

- Not ideal for larger businesses

- Limited to US-based businesses

Rippling

- Best For-Automatic filling of tax benefits and payroll processing

- Starting Price -$8 per user per month

- Plans Yes. Benefits tracking through sync with HR management

Rippling’s Payroll tool is a useful addition to its employee benefits management module, which it integrates with fully. Although the tool only supports payments by check and direct bank deposit, it is capable of supporting quick, one-click 90 second payroll for companies with 1 employee or more than 1,000. Rippling can put together custom quotes for prospects depending on the modules and seats required.

Prons

- Integrates with HRM component

- 90 second one-click payroll

- Automatic tax filing

Cons

- Check and bank support only

- Separate subscription to HRM

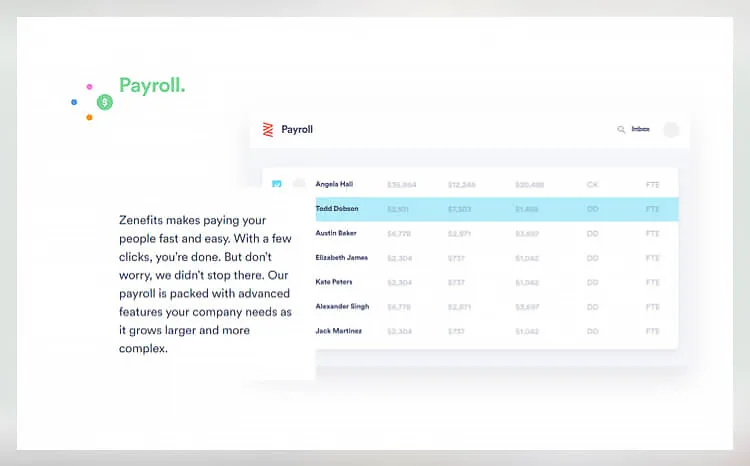

Zenefits

- Best For-Employee benefits

- Starting Price -From $8

- Plans -401k, supplemental, FSHA HSA, commuter

Zenefits is an easy to use payroll service that provides self-service as its default for an easier and faster user experience. And while its payroll services are great, Zenefits really shines in the employee benefits department. You can get everything from employee medical, dental, and vision to life and disability insurance, 401k retirement funds, FSA and HSA accounts, commuter benefits, and more.

That’s not to say Zenefits doesn’t have a solid payroll services online, because it does. The payroll end is reliable and straightforward. Zenefits includes features like unlimited pay runs, garnishments, tips reporting, and contractor payments. You’ll also be able to get dynamic mobile paystubs via a user-friendly app.

Prons

- Extensive employee benefits

- Easy to use self-service dash

- Powerful business intelligence reporting

Cons

- Can’t do everything from the mobile app

- Bit of a learning curve

10

Zenefits

- Best For-Hourly employees, retailers, SMBs

- Starting Price -From $29

- Plans -Health, 401k, workers comp, pre-tax

Boost Mobile is an MVNO formerly owned by Sprint and recently bought by Dish Wireless, a Dish Network subsidiary. Boost Mobile uses T-Mobile’s network to provide service to customers in the United States, but will move over to Dish Wireless’s own 5G network in future. (Dish Wireless is in the process of building the first standalone 5G broadband network in the United States and has committed to covering 70% of Americans by June 2023).

Boost Mobile is a leader in prepaid plans, where you pay at the start of the month. The benefit to this type of service is that it’s super-cheap – with plans starting from $10/month for unlimited talk and text with 1 GB of high-speed data through to $45/month for unlimited talk and text and 15 GB high-speed data. The premium $45 plan discounts to $35/month after six on-time payments.

Pros

- Fast and easy software to use

- Run payroll multiple times per month

- Affordable and feature-rich

Cons

- Reporting feature is limited

- Doesn’t support all payment options

Frequently Asked Questions

free trials and other perks for signing up, such as Gusto and ADP.

The first step is to find the right service for your business’ size and needs. Then all you need to do is sign up, choose a plan, download the necessary software if applicable, and familiarize yourself with its tools and features.

The Benefits of Using a Payroll Service

Payroll used to be the bane of any manager or employer’s existence. Once a month (or possibly more, depending on the company’s payment structure), they’d have to sit with the painful task of calculating, checking, complying, and organizing payroll for each employee. This included time off, sick leave, vacation days, salaried, hourly, temp employees, the works. Everyone gave a huge sigh of relief when payroll services and software came onto the scene.

The obvious benefit of using a payroll service is that this time-guzzling task is taken off your shoulders and your mind. In addition to that, though, there are other benefits a savvy business owner can glean using a reliable payroll service like:

Removes human error

Thousands of dollars are lost every year to businesses just because of a misplaced period or a forgotten zero. When people are crunching numbers, errors can happen. When machines do the work, that margin of error is reduced to negligible figures or erased altogether.

Tax compliance

Most good payroll services providers will also offer tax compliance and filing within their packages. This includes calculating, filing, reporting, and any other tax requirements needed. It also means that you’ll stay fully compliant since these services stay up to date with the ever-changing legal requirements for each state and business.

Keep employees in the loop

Payroll services keep all the important payroll data in one secure but easy to access location for all employees. So, your workers can quickly print out pay stubs, get a birds’ eye view of their annual payouts, or add information as necessary.

Other benefits include saving money with reporting and data analysis, better time efficiency, and human resource management like new-hire onboarding, vacation days calculating, and benefits management.

How to Choose the Right Service for You

While there is no telling a business which software or service will be the best fit for them, there are a few key features to look out for when doing your comparison shopping. Before signing up for any service, make sure it’s got these all-important checkboxes ticked off:

- Full payroll management: Today, you really shouldn’t have to do anything but click a button or two to get payroll underway.

- Easy payment methods: Whether you prefer direct deposit, pay cards, or business checks, make sure your payroll software has the options you want, so you can pay your employees quickly and with ease.

- Tax filing: This is one of the biggest perks of using payroll software today. Make sure the payroll service providers you’re looking at are fully tax compliant, meaning they file all your taxes, keep up to date with changes, and will send out forms and files like W-2s and 1099s for all of your employees.

- Compensation management: Taxes aren’t the only thing that need managing. Make sure your payroll services online take care of things like workers’ comp, bonuses, adjustments, and any other extras required by law.

- HR benefits management: What benefits are included in your payroll service? Will they handle health like dental or vision care? Are there added perks like fitness and mental wellness packages? The more you can give your employees, the happier and more productive they’ll be.

- Employee self-serve: This isn’t an essential feature, but it sure is useful. Employee self-serve means your employees can submit information for themselves. This way, you don’t have to spend valuable time inputting all that data. It also means your employees can access their own information, so your workers can print their own pay stubs or check how many vacation days they have left without bothering you for this simple data search.

- Reporting: Reporting is an important feature that lets you gain valuable insight into the inner workings of your organization. From taxes and budget overviews to employee productivity evaluations, reporting is an essential form of business intelligence you don’t want to do without.

The Difference Between a Payroll Software and a Payroll Service

At first glance, payroll software doesn’t appear any different than the payroll services you are used to. Upon closer look, however, you’ll notice some important differences that could make the choice of which type of payroll you want to invest in easier. Here are a few key areas where these two options diverge:

Security

Probably the most important aspect where payroll software and services differ is in security. Payroll services require you to send them all your employee information in order to run payroll. This includes highly sensitive data like employee identification numbers, bank information, and employee records. Of course, all of this is done through highly secure channels with the strongest levels of encryption. But the fact is that you are still sending over your extremely sensitive data.

Payroll software, on the other hand, lets you handle all of your payroll requirements without having to shift any sensitive data over to anyone else. You keep all of your information on your own servers, and only your eyes ever see these details. So, it’s a safer option to be sure.

Convenience

Payroll services has an edge over payroll software on this one. While it’s laughably simple to run payroll from most of the top payroll services online today, being able to hand over all the information for someone else to click those buttons is one step easier. So, if you’re looking for total hands-free, payroll services is a better bet.

Price

Of course, one of the biggest factors most companies will look at when comparing payroll options is the price tag. Hands down payroll software wins this battle. That’s because you simply can’t compare a software pricing structure with a service one. So, if money is an important factor, payroll software will win the war.