There are many factors to consider when purchasing a home warranty, but one of the most important is whether it’s worth having. In this Complete Care Home Warranty review, we will take a look at how this company stacks up against other options and see if it’s worth shelling out for their coverage.

What is the Complete Care Home Warranty?

Complete Care Home Warranty is a warranty that covers repairs and replacements to your home. With Complete Care, you can be assured that you will be taken care of should there be any issues with your home. There are a few important things to keep in mind before signing up for this warranty.

First, make sure that you have an accurate address for your home. The warranty will not cover repairs or replacements if the issue is due to moving or renovating your home. Second, the warranty only covers major items such as appliances, windows, water heaters, and roofs. Minor issues such as peeling paint or blown out light bulbs are not covered. Finally, the warranty does not cover emergency repairs or replacement costs. If there is an emergency and you need help right away, you will need to find another solution.

Overall, Complete Care Home Warranty is a great option for those who want some peace of mind when it comes to their home. While it may not cover everything, it is a valuable added protection for those who take advantage of it.

The Complete Care Home Warranty is a warranty from a provider of home services that covers repairs or replacements done on your residential property. You can find providers in most major cities.

When you purchase the warranty, the provider will send you a kit that has all the information you need to make a claim. The kit will also have instructions for filing the claim and copies of any documentation that may be needed.

The warranty typically covers things such as water damage, broken hardware, and other typical home repairs. The warranty doesn’t cover losses due to theft or natural disasters.

Complete Care Home Warranty review: Is It Worth Having?

The Complete Care Home Warranty is a great way to protect your residential property in case of any repairs or replacements. Providers send you a kit with all the information you need to file a claim, and coverage typically includes water damage, broken hardware, and other typical home repairs. Coverage doesn’t include losses due to theft or natural disasters, but overall this is a great warranty option if you’re worried about something happening to your home.

What are the benefits of having a Complete Care Home Warranty?

A Complete Care Home Warranty can offer peace of mind when it comes to your home. Protecting your investment is important, and a warranty does just that. Here are some of the benefits you could expect:

-Protection from unexpected repairs or replacements.

-Fast, hassle-free claims processing.

-The assurance of quality workmanship.

-24/7 customer service.

-The assurance of coverage for incidents that occur during normal use of the home, not just during an emergency.

When you purchase a Complete Care Home Warranty, you’re getting a guarantee that your home will be taken care of. If something goes wrong, don’t worry – the warranty company will take care of it. Plus, they’ll have 24/7 customer service to help with any questions or issues you may have. So whether you’re planning a remodel or just want to ensure your home is protected in case of an unexpected repair, a Complete Care Home Warranty is a great option.

If you are like most homeowners, you probably take for granted the many features and benefits of a home warranty. But, if something went wrong with your home and you needed to use your warranty, you may have been surprised at the limited coverage that many warranties provide. That’s why it’s important to understand what a complete care home warranty offers – and whether or not it’s worth having one. Here are some key benefits to consider:

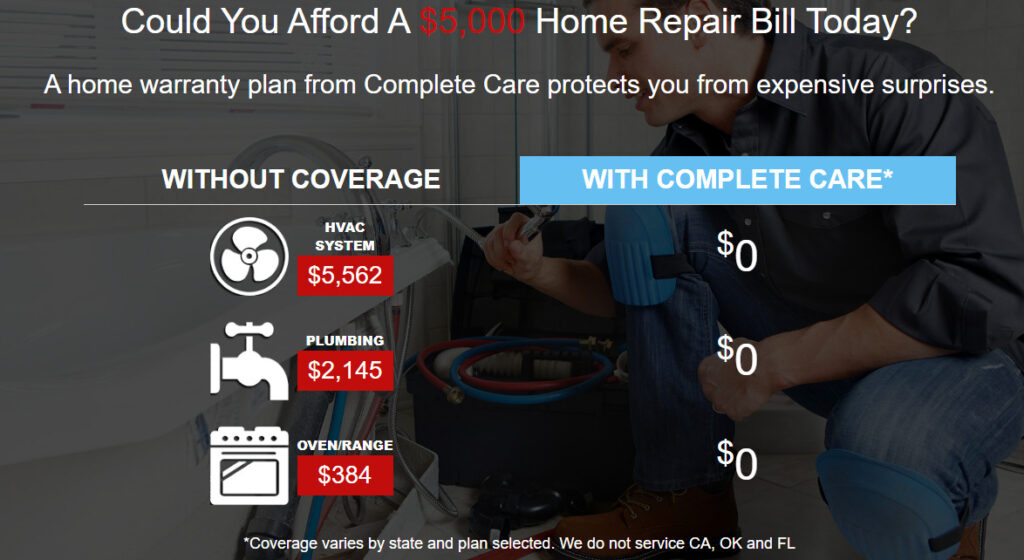

1. Comprehensive Coverage: A complete care home warranty covers a wide range of issues, from mechanical failures to water damage. This means that you can rest assured that your home will be taken care of in the event of an emergency.

2. Priority Service: When you call for service under your warranty, the company will immediately send someone out to take care of the problem. This ensures that you don’t have to wait long for help, and that any repairs are completed as quickly as possible.

3. No hassle claims process: If something goes wrong with your home and you need to file a claim, there is no need to worry about complicated paperwork or long waiting times. The company will take care of everything for you.

How much does it cost to have a Complete Care Home Warranty?

Complete Care Home Warranty is a warranty that offers coverage for repairs or replacements of major appliances, HVAC systems and more. The warranty provides 24/7 support and can be purchased in addition to other home insurance policies.

The cost of Complete Care Home Warranty varies depending on the policy purchased. The warranty typically covers up to $500,000 in damages or repairs. If a claim is made, the policy will cover the cost of repairs or replacements.

There are several benefits to purchasing a Complete Care Home Warranty. For example, if an appliance breaks down and needs to be replaced, the warranty will cover the cost of the new appliance. In addition, if there is a problem with an HVAC system, the warranty will cover repairs or replacements.

Overall, Complete Care Home Warranty is a great way to protect your home from potential damage or repairs. The cost of the warranty varies depending on the policy purchased, but generally costs around $100 per year. If a claim is made, the policy will cover the cost of repairs or replacements.

Is it worth having a Complete Care Home Warranty?

Complete Care Home Warranty is a valuable protection plan for home owners. The warranty covers everything from repairs and replacement of essential parts to accidental damage, including water damage. The warranty also includes 24/7 customer service, so homeowners can always get assistance if needed.

The Complete Care Home Warranty is an excellent way to protect your home and family. The warranty provides peace of mind in the event of a repair or replacement and the customer service is top-notch. If you are considering purchasing a Complete Care Home Warranty, we recommend doing so!

What is Included in a Complete Care Home Warranty?

A Complete Care Home Warranty is a warranty offered by some home insurance companies that covers the costs of repairs or replacements for major items in a home that are not the homeowner’s responsibility, such as appliances, wiring, and plumbing. Coverage typically includes both property damage and liability.

Benefits of having a Complete Care Home Warranty include peace of mind if there is a problem with your home, knowing that you are covered in the event of an accident or unexpected expense, and potential savings on repairs or replacements. There are several factors to consider when deciding if a Complete Care Home Warranty is right for you, including the age of your home, its condition, and what type of coverage you want.

Some things to keep in mind when considering a Complete Care Home Warranty include whether you have any existing warranties covering your home; what type of coverage you want; how much it would cost to cover your home; how often the warranty needs to be renewed; and whether you are comfortable with an insurance company managing the warranty on your behalf.

How Does the Complete Care Home Warranty Work?

If you’re considering purchasing a home warranty, then you might be wondering how the Complete Care Home Warranty works. The Complete Care Home Warranty is an optional coverage offered by the company that makes up the foundation of this blog section. Here, we’ll explain what it entails and whether or not it’s worth having it.

The Complete Care Home Warranty is designed to provide comprehensive protection against repairs or replacements that are required due to defects in your home’s construction or mechanical systems. Coverage includes everything from electrical and HVAC systems to window and door repairs. In addition, the warranty provides 24/7 emergency assistance should you need it.

There is no annual cost associated with this warranty, and you can use it regardless of your insurance coverage. Simply call the company’s toll-free line and provide them with your homeowner’s insurance information. After that, they’ll arrange for a Claims Specialist to come out and assess the damage in your home. If there are any issues with your claim, they will work to resolve them as quickly and efficiently as possible.

Complete Care Home Warranty is a protection plan that covers your home against major repairs or replacements. Complete Care will pay for the cost of repairs or replacements, up to $100,000 per occurrence.

To be eligible for the Complete Care Home Warranty, you must have a home insurance policy with Complete Care as an additional coverage option. The warranty is available on new and pre-owned homes.

The warranty is good for one year from the date of purchase, and it covers both indoor and outdoor areas of your home. The only exclusion are damages caused by natural disasters, like hurricanes or floods.

If you have a qualifying policy and your home is damaged during covered incidents, Complete Care will pay for the cost of repairs or replacements. They will also cover the costs of moving you and your belongings out if necessary.

There is no deductible, and there are no additional fees for using the warranty. You can file a claim online or over the phone.

Conclusion

When it comes to home warranties, there are a lot of options available to consumers. So which one is right for you? In this Complete Care Home Warranty review, we take a look at the company and see if it’s worth having protection from damage or theft on your property. After weighing the pros and cons, we conclude that Complete Care Home Warranty is a good choice for most people.