Top 10 Best Accounting Software for Small Business

Most new small businesses use spreadsheets to manage their books, and some maintain this practice as they expand.

In addition to being time-consuming, this creates the problem of having lots of different documents with conflicting or outdated numbers. The solution? Small business accounting software.

Small business accounting software can help organize your business across the board, from creating reports needed for tax purposes to helping you keep projects on budget.

We looked at a number of the best online accounting software programs to help you compare features and prices and pick the best tool for your business.

- Best for:- Cloud-centric accounting

- Price range– From $12.50 / month

- Free trial or free version?– Free 30-day trial

- Bank account integration?- Yes

- Payroll included? – Additional add-on

- Best for:- Enterprises and global companies

- Price range-$999+

- Free trial or free version?– No (Demos available)

- Bank account integration?- Yes

- Payroll included? – Yes (additional module)

- Best for:- User-friendly invoicing and accounting

- Price range-From $13.50 per month

- Free trial or free version?-Free 30-day trial

- Bank account integration?- Yes (integrates with more than 14,000 financial institutions)

- Payroll included? – No

- Best for:- Business owners, bookkeepers, and SMBs accountants

- Price range– Free-$60/month

- Free trial or free version?-Free 30-day trial

- Bank account integration?-

- Payroll included? –

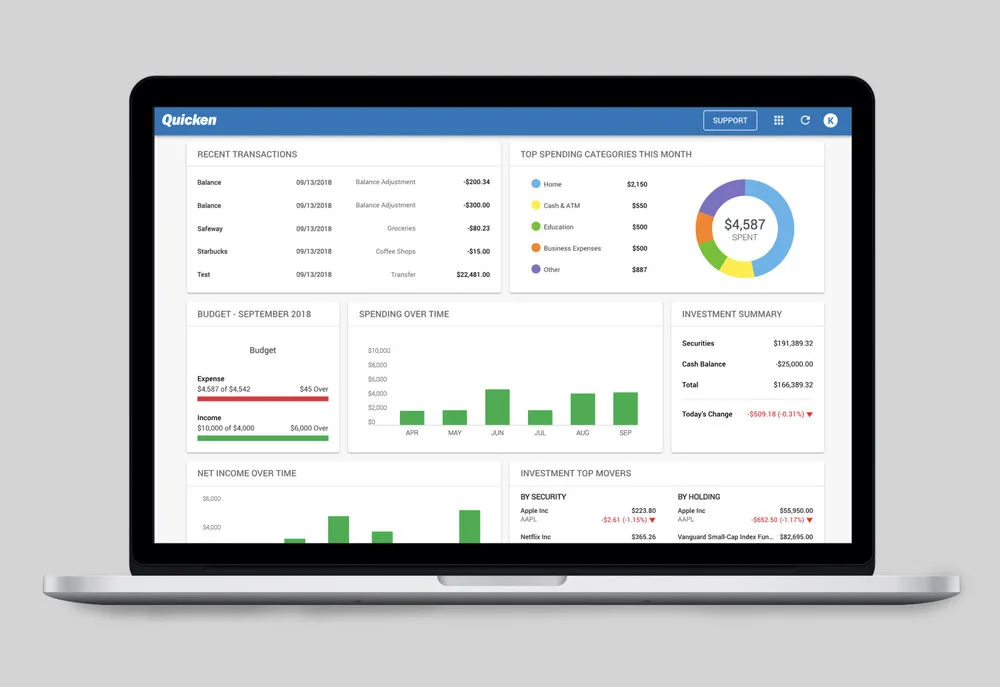

- Best for:- Those looking to stick to a budget

- Price range-$31.19

- Free trial or free version?– No trial version.

- Bank account integration?-

- Payroll included? –

Our reviews come from verified users–just like you!

The star ratings are based on the overall rating of each brand. Some reviews are provided via third party suppliers. We encourage you to write a review of your experiences with these brands.

- Best For- Cloud-centric accounting

- Price range -From $12.50 / month

- Free trial or free version-Free 30-day trial

Quickbooks is a comprehensive accounting system designed for small businesses through to organizations at the advanced scales of staging.

The tool includes OCR-backed expense receipt tracking, invoice issuing, and for an add-on users can add the payroll functionality. Not all features are available on the mobile apps, but users can even use these, in conjunction with hardware, to process payments.

Prons

- Apps for iOS and Android

- Project profitability tracking

- Easy hour billing with integrations

Cons

- No free tier

- Not all features available on mobile

- Best For- Enterprises and global companies

- Price range-$999+

- Free trial or free version-No (Demos available)

NetSuite is hard to beat in terms of power and customizability, although it comes with a steep learning curve. The user support is also quite limited for basic subscribers, another reason why smaller businesses may find the experience too labor-intensive. The suite, however, is extensive enough to replace a variety of other operational and logistical applications (like CRM and HR), which can ultimately reduce the overall cost, both in terms of labor and money.

NetSuite is an excellent solution for enterprises and global companies that need to manage large operations with many moving parts and which have the human and financial resources to use NetSuite’s powerful platform to build the perfect ERM solution.

Prons

- Highly customizable

- Extremely powerful budgeting, forecasting and reporting

- All-in-one solution (HR, project management, inventory, etc.)

Cons

- Complex to set-up and operate

- Can be very costly

- Best For-User-friendly invoicing and accounting

- Price range-From $13.50 per month

- Free trial or free version-Free 30-day trial

If you’re a business owner looking for a quick and easy way to bill your clients, then Freshbooks could be the user-friendly option you have been looking for.

Creating invoices and expenses with Freshbooks is as easy as clicking and typing into fillable document fields. The system can also scale to support more than 500 clients

Prons

- Scalable to bill more than 500 clients

- Clickable document editing

- Payroll via integration

Cons

- No built-in payroll functionality

- Mobile mileage tracking only on higher tiers

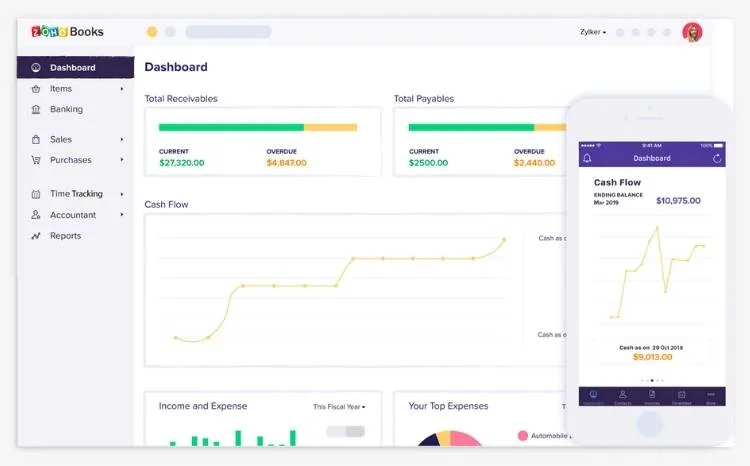

- Best For-Business owners, bookkeepers, and accountants of SMBs

- Price range -Free-$60/month

- Free trial or free versionFree version and free trial

Zoho Books is an online accounting platform that business owners can use to manage cash flows, track expenses, pay bills, invoice clients, and accept payments. There are 4 pricing tiers—free, standard, professional, and premium—and the more expensive plans contain a larger set of features.

For added functionality, Zoho Books integrates with a number of platforms, including inventory management, customer relationship management software, and payroll services. Zoho’s website also contains a repository of educational materials that customers can use to familiarize themselves with the platform and accounting best practices.

Prons

- Intuitive interface and sleek dashboard design

- Offers an expansive array of core features; add-on enhancements available

- Features grow with your business

Cons

- Lacks payroll and inventory management features

- No customized plan for larger organizations

- Best For-Business owners, bookkeepers, and accountants of SMBs

- Price range -Free-$60/month

- Free trial or free versionFree version and free trial

Prons

- Intuitive interface and sleek dashboard design

- Offers an expansive array of core features; add-on enhancements available

- Features grow with your business

Cons

- Lacks payroll and inventory management features

- No customized plan for larger organizations

Zoho Books is an online accounting platform that business owners can use to manage cash flows, track expenses, pay bills, invoice clients, and accept payments. There are 4 pricing tiers—free, standard, professional, and premium—and the more expensive plans contain a larger set of features.

For added functionality, Zoho Books integrates with a number of platforms, including inventory management, customer relationship management software, and payroll services. Zoho’s website also contains a repository of educational materials that customers can use to familiarize themselves with the platform and accounting best practices.

What is Accounting Software?

Accounting software is software that automates accounting and bookkeeping tasks like invoicing, accounts payable, accounts receivable, income, and expenses. Small business accounting software puts all your financial information in one place, making it easier to share data across teams or externally and saving your employees from double entries or having to type things in manually.

The best accounting software for small business comes in 2 forms: desktop accounting software or online accounting software. Desktop accounting software is an application you install on your company’s computers. Online accounting software, also known as software-as-a-service or SaaS, has the same functions but runs on the cloud.

What Features Should You Look for in Your Accounting Software?

At a minimum, your accounting software is an online bookkeeping program that carries out the core accounting processes we mentioned earlier–such as invoicing, accounts payable, accounts receivable, income, and expenses. But that’s not all it should do. Below are some of the advanced features included in the best accounting software for small business.

Tax integration. Your accounting software should provide balance sheets, profit and loss reports, and any other customized reports you or your accountant require in order to file taxes. The top bookkeeping software even lets you photograph and save receipts using a mobile device so you have it all stored securely for tax time.

Payroll management. Payroll usually isn’t built into accounting software but is offered through integrations with third-party payroll and HR software. Once everything is set up, your software will be able to calculate and file your payroll, pay payroll taxes, pay with same-day direct deposit, and manage employee benefits.

Business insights. Online accounting software programs gather a lot of data about your business, so why not use all that data to your advantage? The best programs offer business insights and intelligence through user-friendly reports and dashboards.

Custom invoices and receipts. Remember, every interaction with customers and service providers is an opportunity to promote your brand. Some accounting programs let you create custom invoices and receipts, helping to make your brand more memorable.

Multi-user access. Depending on the size of your business, you may want to grant access to more than one person. The best accounting software programs offer plans for multiple users, including access for your accountant.

Support for mobile You never know when you might need to capture or access data from a mobile device. Most of the big names in accounting software offer free iOS and Android apps.

Unlimited cloud storage. One of the benefits of using online accounting software is that all your data gets stored in the cloud, where capacity is virtually unlimited.

Free support. If something goes wrong, then you want to know your software provider has your back. Premium subscriptions usually include a dedicated account team.

Scalability. Accounting software is perfect for the rapidly-expanding business that finds that manual entries no longer cut it. The sky’s the limit for your business–and so you need software that offers small business accounting services that scale with you.

User-friendly. Last, but not least, is user-friendliness. Your accounting and invoicing software should be easy enough for anyone on your team to learn how to use it within a couple of hours.

How Much Does Accounting Software Cost?

Like most software-as-a-service, the cost of online accounting software really depends on how many features you need and how many users need access. Pricing models can really vary when it comes to accounting software. Some providers charge a fixed per-month price with all or most of the features included, while others offer tiered pricing that gradually gets more expensive as more features are integrated.

Based on our research of the top providers, accounting software could cost anywhere from $12 to $300 per month. The cheapest subscriptions automate basic accounting functions such as tracking income and expenses, invoicing and accepting payments, managing cash flow, tracking sales and sales tax, and sending estimates. Integrating payroll costs extra—it’s built into some of the more expensive plans or costs another $4 – $10 per employee per month as an add-on. Advanced features like income tax return preparation almost always cost extra.

What is the Best Free Accounting Software?

Believe it or not, there is such thing as free accounting software–and we’re not just talking about Excel or Google Sheets. The biggest names in free accounting software include Wave, ZipBooks, and SlickPie. All of these are web-based accounting programs offering basic functions like managing accounts receivable, tracking expenses, and creating profit & loss and balance sheet statements.

Free accounting software is a good stepping stone for sole proprietors and very small businesses looking to upgrade on spreadsheet programs like Excel and Google Sheets. They essentially let you do all the things Excel and Google Sheets could potentially do for you if you had the time to program all the necessary formulas yourself.

While free software is handy for doing basic things, the reality is it won’t give you anything close to the features offered by paid accounting software. If you need software that can carry out functions like managing payroll, tracking inventory, or handling tax preparation—then you’re going to need to pay for it.

Conclusion

If you can afford to automate administrative business tasks, then you probably should. Carrying out accounting tasks manually may be cheaper in the short-term, but you’ll quickly find it takes away time from growing your business and exposes you to the risk of potentially costly errors. The best accounting software grows with you, so you can start by automating just the core accounting tasks and then add on more complex tasks like payroll and tax reporting as you go. Once you begin using small business accounting software, you’ll quickly find yourself wondering why you ever did things manually.